Lorem ipsum dolor sit amet, dolor siterim consectetur adipiscing elit. Phasellus duio faucibus est sed facilisis viverra. Umero praesent nec accumsan nibh, eu grav da metus.

Chargebacks Explained for Sellers

3 min read

- What Is a Chargeback? (Plain English)

- Chargeback vs Order Dispute (Very Important Difference)

- Common Reasons Buyers File Chargebacks

- What Happens When a Chargeback Is Filed

- What Sellers Should Do (And Not Do)

- How Seller Protection Applies to Chargebacks

- What Evidence Is Used in Chargebacks

- How Long Chargebacks Take to Resolve

- How Chargebacks Affect Sellers

- How Dispatched by Kingston Express Reduces Chargebacks

- Common Seller Mistakes With Chargebacks

- How to Reduce Chargeback Risk Long-Term

- Final Rule (This Stops Fear)

(Seller Disputes & Protection – Seller Guide)

A chargeback sounds scary — but when you understand how it works, it becomes manageable and rare.

On Kingston Express, chargebacks follow a separate financial review process and do not automatically mean seller fault, especially for orders Dispatched by Kingston Express.

This guide explains:

- What a chargeback really is

- How chargebacks differ from disputes

- What happens step by step

- How sellers are protected

- How to reduce chargeback risk

What Is a Chargeback? (Plain English) #

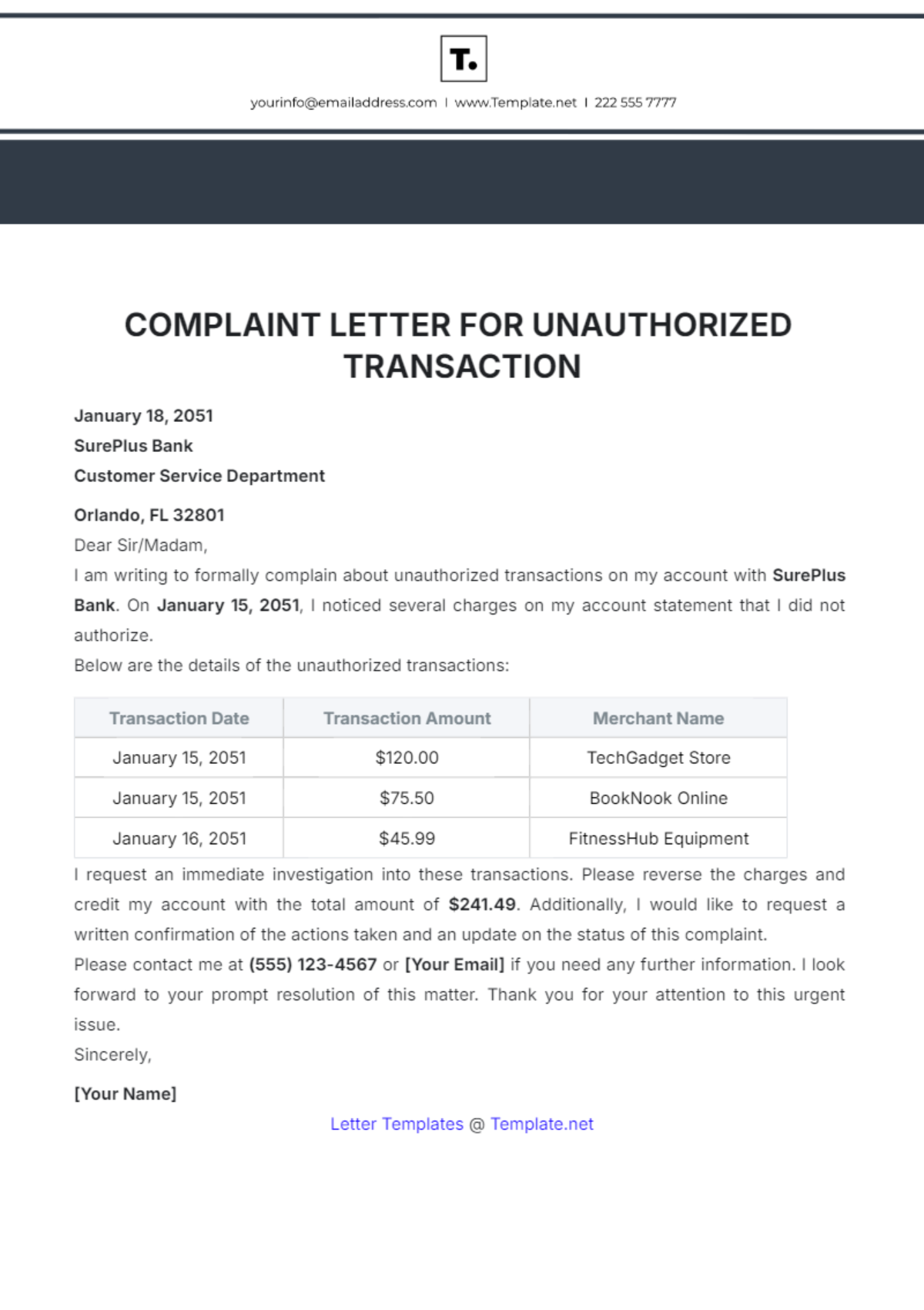

A chargeback happens when:

- A buyer contacts their bank or card provider

- The buyer disputes the transaction

- The bank temporarily reverses the payment

- The transaction is reviewed by financial institutions

📌 This happens outside the normal order dispute flow.

Chargeback vs Order Dispute (Very Important Difference) #

| Area | Order Dispute | Chargeback |

|---|---|---|

| Started by | Buyer on platform | Buyer’s bank |

| Reviewed by | Platform | Bank + platform |

| Speed | Usually faster | Slower |

| Seller action | Sometimes required | Usually none initially |

| Stress level | Medium | High (but manageable) |

📌 Chargebacks feel bigger — but sellers are not powerless.

Common Reasons Buyers File Chargebacks #

Most chargebacks are filed due to:

- “Item not received”

- “Unauthorized transaction”

- “Item not as described”

- Confusion about billing descriptor

- Buyer skipping the dispute process

📌 Many chargebacks start from misunderstanding.

What Happens When a Chargeback Is Filed #

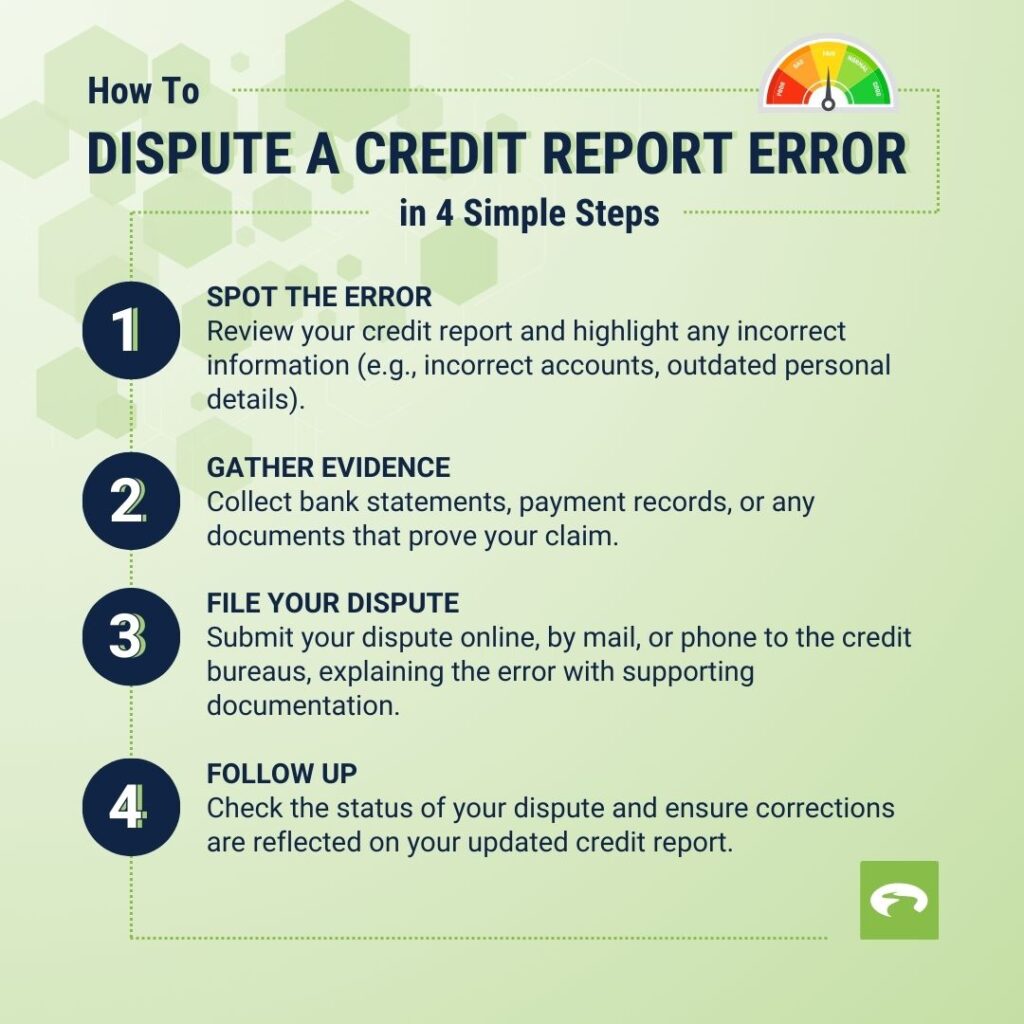

When a chargeback occurs:

1️⃣ Bank notifies the platform

2️⃣ Funds are temporarily held or reversed

3️⃣ Transaction enters financial review

4️⃣ Evidence is submitted on seller’s behalf

5️⃣ Bank issues a final decision

📌 This process takes time — patience matters.

What Sellers Should Do (And Not Do) #

✔ Sellers SHOULD: #

- Stay calm

- Monitor notifications

- Let the process complete

❌ Sellers should NOT: #

- Contact the buyer

- Issue off-platform refunds

- Submit duplicate evidence

- Panic message support

📌 Interfering can reduce protection.

How Seller Protection Applies to Chargebacks #

Sellers are protected when:

✔ Order was fulfilled correctly

✔ Delivery is confirmed

✔ Platform records support the transaction

✔ Seller followed all processes

📦 Dispatched by Kingston Express

- Verified delivery and handling records

- Strong defense against “item not received” claims

📌 Compliance = protection.

What Evidence Is Used in Chargebacks #

Evidence may include:

- Order confirmation

- Delivery confirmation

- Tracking records

- Dispatchment packing logs

- Listing details

📊 Platform submits this evidence automatically in most cases.

How Long Chargebacks Take to Resolve #

Typical timelines:

- Several weeks

- Sometimes longer for international transactions

📌 Slow does not mean negative.

How Chargebacks Affect Sellers #

Chargebacks:

- Do NOT automatically hurt ratings

- Do NOT automatically cause suspension

- Are monitored as patterns, not one-offs

📌 Repeated chargebacks may trigger review — isolated ones usually do not.

How Dispatched by Kingston Express Reduces Chargebacks #

Dispatchment reduces chargebacks by:

- Preventing delivery confusion

- Providing authoritative delivery records

- Reducing buyer uncertainty

📦 Clear delivery = fewer bank disputes.

Common Seller Mistakes With Chargebacks #

❌ Panicking and refunding early

❌ Contacting buyers directly

❌ Ignoring notifications

❌ Breaking process rules

⚠️ Calm sellers lose fewer chargebacks.

How to Reduce Chargeback Risk Long-Term #

✔ Accurate listings

✔ Clear delivery timelines

✔ Reliable fulfillment

✔ Strong communication

✔ Use dispatchment for scale

📈 Prevention beats recovery.

Final Rule (This Stops Fear) #

👉 A chargeback is a financial review — not a judgment of your business.

Sellers who follow process, stay compliant, and rely on Dispatched by Kingston Express are strongly protected and resolve chargebacks without long-term damage 🛡️💳📦

Jamaica

Jamaica